Knowledge Base

27

Oct

2016

A Guide to Diaspora Mortgages in Kenya 2

By Tags :

Diaspora mortgages provide an affordable way to invest in property at home. Coupled with steady rental income, they have the potential to reduce the carrying cost of your investment property in Kenya. Learn how you can benefit from a Diaspora mortgage with our guide

Application requirements*

- A valid visa for your country of residence

- Avalid work permit for the country of residence

- Proof of employment (letter from your employer)

- A certificate of completion issued by the architect

- Property valuation

- The property title deed

- A diaspora bank account (from which monthly payments are withdrawn)*

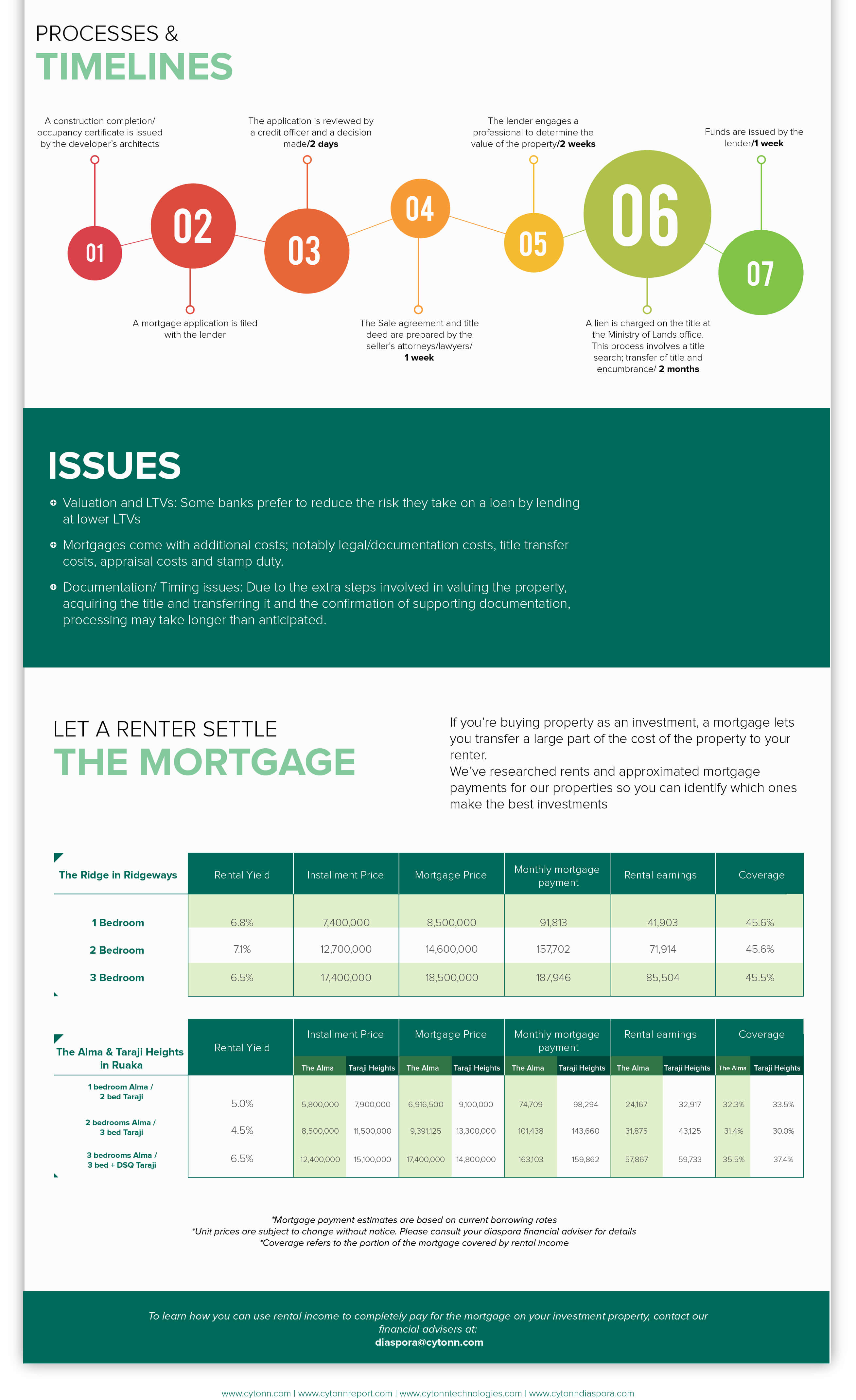

Processes and Timelines

- A construction completion/ occupancy certificate is issued by the developer’s architects

- A mortgage application is filed with the lender

- The application is reviewed by a credit officer and a decision made/2 days

- The Sale agreement and title deed are prepared by the seller’s attorneys/lawyers/1 week

- The lender engages a professional to determine the value of the property/2 weeks

- A lien is charged on the title at the Ministry of Lands office. This process involves a title search; transfer of title and encumbrance/ 2 months

- Funds are issued by the lender/1 week

Issues

- Valuation and LTVs: Some banks prefer to reduce the risk they take on a loan by lending at lower LTVs

- Mortgages come with additional costs; notably legal/documentation costs, title transfer costs etc.

- Documentation/ Timing issues: Due to the extra steps involved in valuing the property, acquiring the title and transferring it and the confirmation of supporting documentation, processing may take longer than anticipated.

Let a Renter Settle the Mortgage:

If you’re buying property as an investment, a mortgage lets you transfer a large part of the cost of the property to your renter.

To learn how you can use rental income to completely pay for the mortgage on your home, contact the team at diaspora@cytonn.com

*Application requirements vary from one provider to another

*Pricing data is based on current mortgage rates/ pricing and is subject to change without notice. Please speak to our advisers for up to date pricing